I attended the Grist Webinar this afternoon, and the instructor suggested I leave an “ask for help” request here.

I’m new to Grist, but I’ve worked through many of the reference videos and templates, so I’m not a complete beginner.

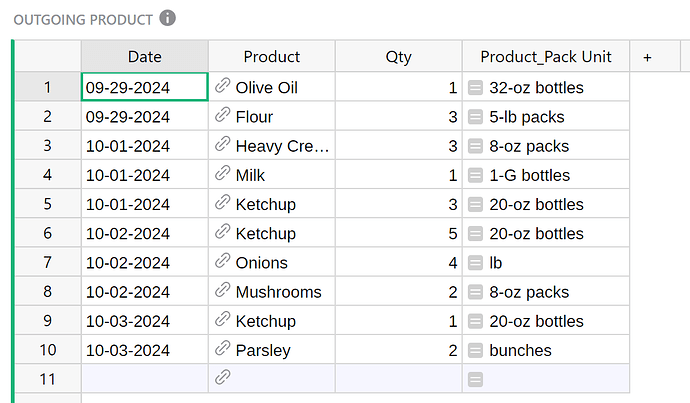

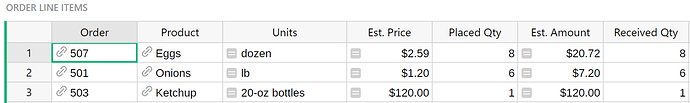

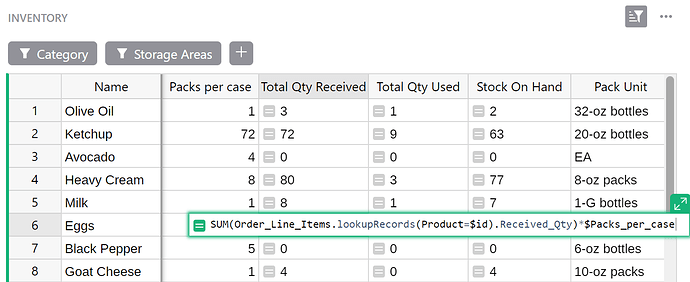

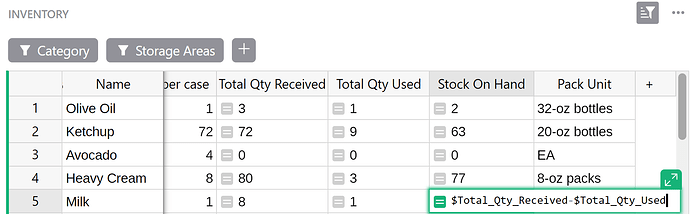

A couple of the templates I’ve spent a good deal of time with are the Restaurant Inventory & Custom Orders templates since the project I’m working on is an inventory tracking relational database. However, when I work with the Restaurant Template, it feels incomplete since you can place and receive ingredients from a new purchase order, yet the inventory doesn’t adjust at all.

Similarly, in the Restaurant Custom orders template, you can adjust existing Bills of Materials (BOM) or create new ones – yet again, the inventory levels don’t adjust.

Perhaps the reason the inventories aren’t impacted by received purchases, completing recipe production (BOMs), and selling goods in these templates is that I am improperly entering new transactions or adjusting existing entries. If that’s the case, please add documentation so these templates’ entire workings and functionality are apparent. Or, even better, do some instructional webinars for these templates.

That said, I suspect the real issue is that transactions like (1) received purchases, (2) producing finished goods from raw materials via BOMs, and (3) the sale of finished goods aren’t impacting inventories because key elements are missing from these templates. Can someone add these missing elements so we see a robust, complete, fully functional template? And if, for some reason, a relational database like Grist cannot deliver on these missing elements, please just let people know this (and maybe explain why) so we can stop spinning our wheels trying to do the impossible.

Personally, I think a robust inventory template and video tutorial would be a great addition to you educational library! I’d love to help make it happen!

Thanks,

Bruce